How to file Income tax Return Online- Forms & Steps

Intoduction

So, the year has finally ended. You have learned a lot of money & it's time to pay taxes & give your Income details to Indian Income Tax Department to prevent yourself from Fines & Penalties. The last day for Filing Return for Individuals is 31st July of Preceding year & for companies, partnerships, HUF & other entities (Other than Individual) it is 30th September of preceding year. So don't forget to do it. Just follow these simple detailed steps & videos to file your return online successfully before the Last date.

Just Follow these 10 steps-

Steps to File Return-

Step 1

The first step is to go on this site of Income tax Department for return filing i.e. www.incometaxindiaefiling.gov.in. It is used for return filing purposes only. Then first register yourself with a Username & Password. Your user ID will be your PAN no. & password you can decide. You will use it to Log In to the site.

Note- Do not share your password with anyone as this site contains a lot of Information about to Source of Incomes.

Other Steps-

Steps

| Details

|

|---|---|

Step 2

| Now when you log in to file your return. There you will see the Download menu. Under the 'Download' menu, go to e-filing (Assessment Year) < Individual/HUF and select the appropriate Income Tax Return (ITR) form. Download ITR-1's (Sahaj) return preparation software if you are a salaried individual, pensioner, own one house property and/or earn interest income.

|

Step 3

| Then open the downloaded Return Preparation Software (excel utility), follow the instructions and fill all the necessary details using Form 16.

|

Step 4

| Then you have to compute the tax payable by clicking the 'Calculate Tax' tab. Then just go & pay tax, either through Net banking or at your bank & fill your Challan details in the return. (Not applicable if the Tax calculated by you is Nil).

|

Step 5

| Confirm the details entered by clicking the 'Validate' tab. Proceed to generate an XML file, which will be automatically saved on your computer. The registration process (i.e. Step 1) can also be initiated at this stage.

|

Step 6

| Go to 'Submit Return' on the portal's left panel and upload the XML file after selecting the relevant Assessment year and the relevant form.

|

How to File Income tax return Online in India- Steps

Steps

| Details

|

|---|---|

Step 7

| You will be asked whether you wish to digitally sign the file. If you have obtained a DS (Digital signature) select 'Yes'. Else, choose 'No' and go ahead. If you have the DS, then you need not use the 8th step as you don't have to send ITR V to CPC. Just take the printout Of ITR V & keep it.

|

Step 8

| Now a message will come on your screen indicating that your return is successfully filed. Once this message regarding successful e-filing is flashed on your screen, the process is completed. The acknowledgement form (ITR-V)-will be generated and you can download the same. It will also be mailed to your registered email ID.

|

Step 9

| Then just go to the ITR- V & open its PDF format. Take the printout of this Acknowledgement, then sign it at the mentioned place, and send it by ordinary or speed post to the Income Tax Department-CPC Address (Post Bag No-1, Electronic City Post Office, Bengaluru - 560 100, Karnataka) within 120 days of uploading your e-return. Couriered documents will not be accepted.

|

Last Step-

Step 10

Now when your I TR V form is received by Income Tax department it will send you the acknowledgement by email, which is the final step in the process of return filing. It may take a week or even a month but not more than that. If you do not receive it from the Income Tax Department in due course, you can send the form I TR-V again by speed post or ordinary post to the same adress. The acknowledgement will be password protected (Password- PAN No. & DOB without any gap). Then at last you will receive Intimation u/s 143, which will show the assessment of department. In case you get refund, it will be sent to your bank a/c & if demand, you need to pay it to department.

Books to File Income Tax Return-

How to file income tax return online

List of ITR Forms with Description-

Form Name

| Description

|

|---|---|

ITR-1 SAHAJ

| Indian Individual Income tax Return for Salaried Employees

|

ITR-2

| For Individuals and HUFs not having Income from Business or Profession

|

ITR-3

| For Individuals/HUFs being partners in firms and not carrying out business or profession under any proprietorship

|

ITR-4

| For Individuals and HUFs having income earned from a proprietory business or profession

|

SUGAM (ITR-4S)

| Sugam - Presumptive Business Income tax Return

|

ITR-5

| For Partnership Firms, Association of Persons (AOP) & Body of Individuals (BOI)

|

ITR-6

| For Companies other than companies claiming exemption under section 11

|

ITR-7

| For persons including companies required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D)

|

ITR-V

| Acknowledgment which is received after filing return

|

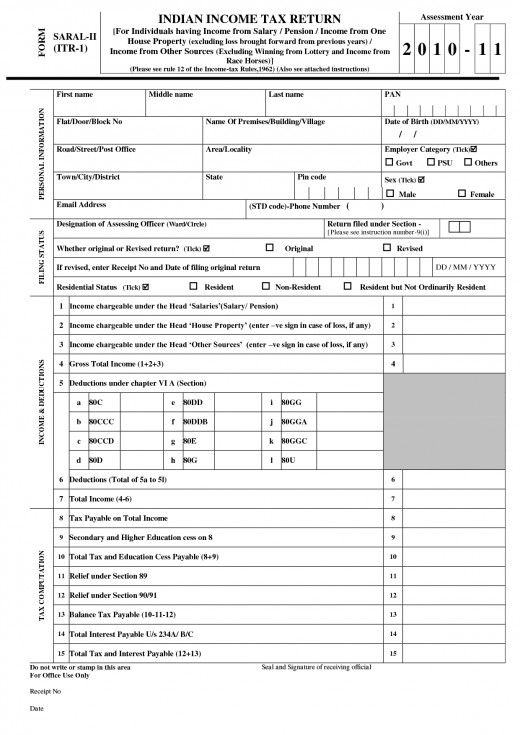

How to fill Income Tax Return Form 1 (ITR 1)

That's it from my side. Hope you enjoyed reading this hub. Thanks a lot for the time you have invested in reading my hub. Do leave your feedback below along with your valuable comment. Cheers!!!!

Please, Leave your Feedback-

Did You Liked this Hub?

Other Articles related to Indian Taxation-

- Indian Income tax act 1961 deductions sections

List of all the Latest Indian Income Tax Act, 1961 Deductions which will help you save a lot of tax & money using Ethical & Legal Sections. So, what are you waiting For- Go Save Your Money. - Depreciation rates chart as per Income Tax Act (F.Y. 2012-13)A.Y. 2013-14

Tax Guru Depreciation rates slabs rules & laws of Income Tax Act,1961 (Assessment year 13-14). These rates are totally different from the ones you use in Companies Act, so don't get confused. Know the right rates before preparing your books. - Depreciation rates as per Companies Act, 1956 F.Y. 2012-13 (A.Y. 2013-14)

Tax Guru Depreciation rates slabs rules & laws of Companies Act, 1956 (Assessment year 13-14). These rates are totally different from the ones you use in Income Tax Act, so don't get confused. Know the right rates before preparing your books. - Amendments in companies Revised Schedule VI

Revised Schedule Vi format is now mandatory for all the Limited Companies. It has a lot of changes from previous format & each change has it's own importance. So, to ensure proper maintenance of books of a/c, do have a look at all these changes. - TDS & TCS Rates as per Act for F.Y. 12-13 (A.Y. 13-14)

List of all the TDS & TCS Rates which you will need before cutting TDS & TCS. Remember, you should be knowing right rates to protect yourself from penalty & other penal provisions of Department. So, Go have a Quick look.....